Have you ever interacted with a chatbot while seeking information about a savings account? Or received a call from your bank verifying credit card transactions? We are witnessing the exponential growth of artificial intelligence (AI), a transformative technology leaving its indelible mark across all industries, finance, and banking included.

AI is revolutionizing the landscape of finance by streamlining processes, automating mundane tasks, enhancing customer service, and contributing positively to overall business growth. Indeed, a forecast by Business Insider suggests that by 2023, AI applications could potentially save banking and financial institutions as much as $447 billion.

An impressive 80% of banks are cognizant of the potential benefits that AI brings to the table. The urgency to adopt AI has been amplified by the ongoing effects of the COVID-19 pandemic, which has significantly impacted the financial industry and accelerated the shift towards a digital-first customer experience.

Mani Nagasundaram, the Senior Vice President and Head of Solutions of Global Financial Services at HCL Technologies, conveyed in a recent article on AI News, that the pandemic has made it imperative for banks and financial institutions to respond more promptly to customer needs, around the clock. The deployment of AI, he suggests, can alleviate the burden on staff, bolster security protocols, and propel the business toward a future where technological innovation is at the forefront.

In corroborating the increased adoption of AI, Forbes notes that a whopping 70% of financial firms utilize machine learning to forecast cash flow events, refine credit scores, and detect fraudulent activities.

In this article, we will delve into the top ten applications of artificial intelligence in the realm of finance.

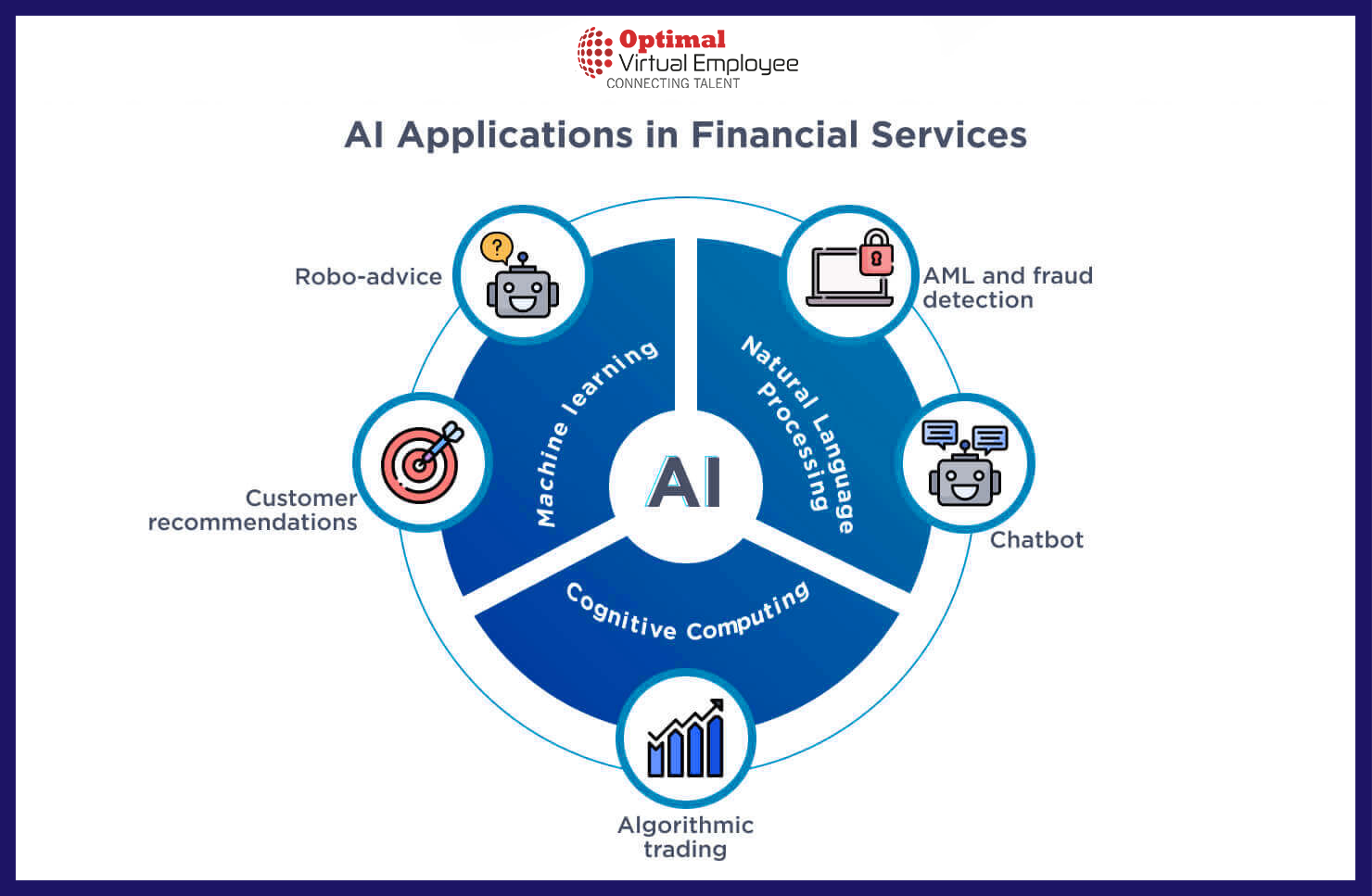

Prime Applications of Artificial Intelligence in the Finance Sector

The advent of AI in finance has opened up a new era of possibilities. Let’s delve into the ten most significant applications of AI in the financial arena.

Enhancing Customer Service

Conversational AI in the finance sector has revolutionized the way customer services are handled. The introduction of AI-enabled chatbots and virtual assistants allows banks and financial institutions to deal with a multitude of customer inquiries swiftly and effectively. These assistants, endowed with natural language processing (NLP) capabilities, can comprehend complex financial inquiries and respond accurately without delay.

Take the case of AI-based voice assistants, integrated into banking apps or smart devices. They provide customers with a seamless interaction experience via voice commands, enabling them to carry out transactions, check account details, and gain tailored financial insights. A case in point is Wells Fargo’s Facebook Messenger chatbot, which employs machine learning to interact effectively with its customers. It is facilitating access to account-related information and passwords, thus showcasing how conversational AI is revolutionizing customer support in financial services.

Additionally, financial organizations can leverage AI algorithms for sentiment analysis to scrutinize customer feedback, reviews, and social media posts. This provides invaluable insights into customer sentiments and preferences, which can be used to enhance service quality.

Detecting Fraud

The deployment of advanced AI solutions in finance aids financial institutions in their fight against fraud. Machine learning algorithms and predictive analytics can analyze large datasets to identify and avert fraudulent activities in real-time. Anomalies in customer behavior, such as sudden high-value transactions from an unfamiliar location, can be flagged instantly as potential fraud cases, thanks to AI.

JPMorgan Chase employs AI to spot fraud in its credit card business by creating a proprietary algorithm that scrutinizes each transaction in real-time to detect fraudulent patterns. Moreover, AI systems can harness various data sources, including social media and external databases, to improve fraud detection capabilities.

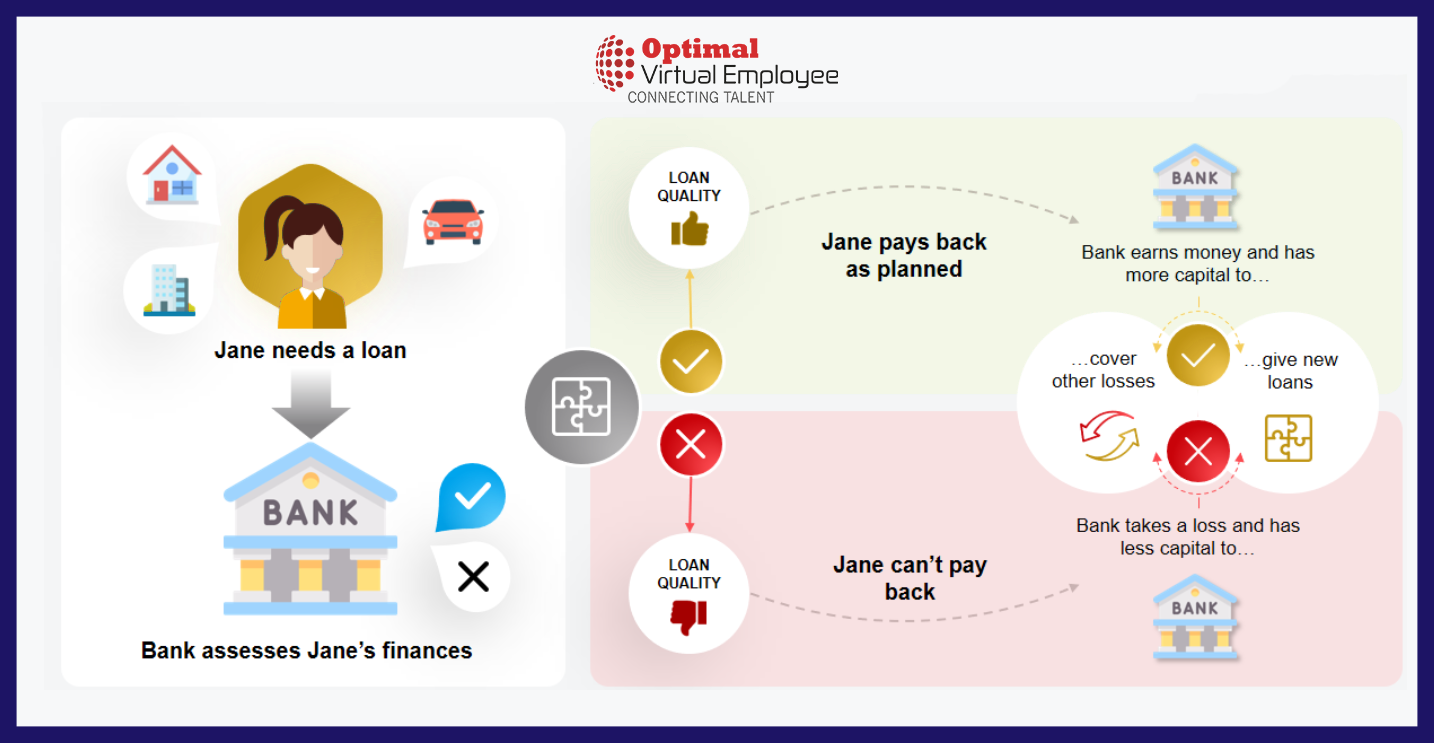

Assessing Credit Risk

The credit risk assessment process has been revolutionized by AI, making the procedure more precise and efficient. Traditional methods were manual and subject to human bias, but AI allows financial institutions to automate this process. Machine learning algorithms and predictive analytics can assess extensive data like credit history, financial reports, and market trends to evaluate the risk associated with granting credit.

For instance, AI-powered credit scoring models analyze historical data, recognize patterns, and estimate the likelihood of default or delinquency, enabling lenders to make informed decisions. These AI systems can also monitor credit risk in real-time, providing early warnings about potential credit defaults or deteriorating creditworthiness.

Offering Personalized Wealth Management

AI’s potential is being harnessed to provide bespoke wealth management services. The analysis of vast data sets, including historical performance and market trends, enables financial institutions to offer personalized advice. AI thus allows institutions to tailor investment strategies to each individual’s preferences, risk tolerance, and financial objectives.

Consider, for instance, an investor aiming to fine-tune their portfolio amidst market volatility. Through machine learning in finance, AI systems can tirelessly track and evaluate market situations, modifying the investment portfolio in real-time to amplify returns.

Take BlackRock’s Aladdin platform as an example. This tool processes enormous volumes of financial data to spot risks and opportunities, providing investment managers with timely insights.

The incorporation of AI in finance is bringing about a sea change by enabling tailored wealth management and offering groundbreaking financial AI solutions. This shift is empowering financial institutions to deliver top-tier services, thereby elevating customer experiences and results. In the sphere of bespoke financial services, AI is dramatically transforming institutional operations.

Compliance

In the financial sector, compliance, ensuring businesses stick to regulatory norms and legal obligations, is crucial. AI has emerged as a pivotal player in this area, transforming compliance processes with its advanced abilities.

AI’s deployment in financial services has significantly enhanced compliance procedures. A standout application of AI in banking and finance is automating compliance tasks like Know Your Customer (KYC) procedures. Machine learning algorithms can scrutinize customer data, spot potential risks, and highlight dubious individuals, thus streamlining the verification process. This efficiency reduces cost, saves time, and assures regulatory compliance.

Financial Planning

AI’s incorporation into finance has significantly reshaped financial planning by harnessing data analytics and machine learning algorithms. AI-powered platforms can analyze historical financial data, market trends, and economic indicators to generate accurate and personalized financial forecasts. Such an AI feature helps banks attract millennials, an important customer demographic globally and equips individuals and businesses to make informed decisions and optimize their financial strategies.

A noteworthy AI application in finance is the use of AI-driven robo-advisors. These platforms use AI to provide personalized investment advice tailored to individual goals, risk tolerance, and market conditions. They offer cost-effective, real-time portfolio management through sophisticated algorithms, allowing individuals to access professional financial planning services at a lower cost.

Recently, conversational AI has become popular in financial planning, letting users interact with virtual assistants. These AI-enabled chatbots can answer questions, provide insights, and even carry out financial transactions, offering personalized assistance and convenience.

Predicting and Managing Bad Debt

Predicting and managing bad debt is a crucial aspect of financial services, and AI is revolutionizing this area.

AI’s application in accounting and finance provides powerful tools for bad debt forecasting. Machine learning algorithms can analyze vast amounts of historical data, including customer payment patterns, credit scores, and economic indicators, to identify potential default risks. Using these insights, financial institutions can make data-driven decisions and take proactive steps to mitigate bad debt.

Moreover, generative AI models can simulate various economic scenarios and evaluate their impact on loan portfolios. This allows financial institutions to assess potential risks and adjust their strategies accordingly. AI applications also extend to automating debt collection processes, improving the chances of successful debt recovery while optimizing resources.

Producing Financial Reports

AI’s role in finance has become increasingly prominent in creating financial reports. AI-powered systems can process large amounts of financial data, including transactions, invoices, and account statements, to automate the report generation process. This is achieved using machine learning algorithms to extract pertinent information, validate data, and produce comprehensive and error-free financial reports.

A significant use of AI in finance is the automation of regulatory reporting. Financial institutions are required to adhere to complex regulations and submit precise reports to regulatory authorities. AI can streamline this process by automatically extracting relevant data, performing calculations, and generating reports compliant with regulatory standards.

Moreover, machine learning facilitates the generation of real-time financial reports by analyzing data almost instantly. This allows stakeholders to access current information for decision-making, revolutionizing the generation of financial reports, and transforming how financial data is processed, analyzed, and utilized.

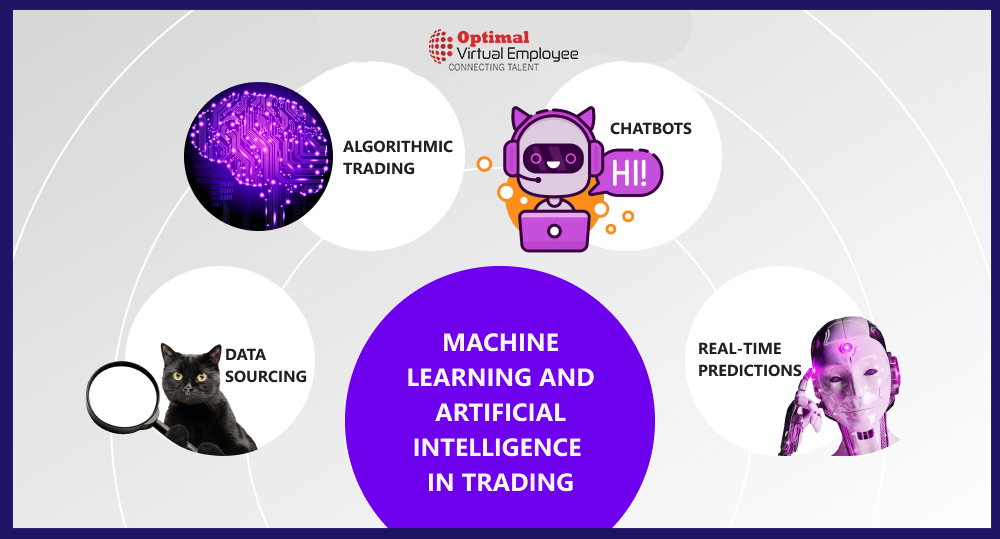

Algorithmic Trading

One of the standout applications of AI in the financial sector is in algorithmic trading. AI’s advanced capabilities are reshaping stock trading by accelerating the decision-making process and making it more precise and data-driven.

The extensive deployment of AI in finance has opened new avenues for algorithmic trading. AI-based algorithms can analyze enormous amounts of market data, including historical price trends, market indicators, and news sentiment, to discern patterns and predict market movements. This allows financial institutions to execute trades with exceptional precision and efficiency.

Conversational AI is also playing a significant role in algorithmic trading within the financial services sector. AI-powered virtual assistants can process traders’ natural language queries, deliver real-time market insights, scrutinize trading strategies, and execute trades based on pre-set parameters.

For instance, Virtu Financial, a global electronic trading firm, uses AI to drive its algorithmic trading platform. The firm’s AI-based platform can scrutinize millions of data points in real-time and execute trades at the most favorable price. Following pre-set trading strategies and risk parameters, the system can automatically execute trades at the most opportune times and prices, seizing market opportunities, and minimizing human errors.

The combination of AI and machine learning (ML) in finance enables algorithmic trading systems to constantly learn from and adapt to market conditions. Machine learning algorithms can dynamically tweak trading strategies based on real-time data, optimizing performance, and maximizing returns.

Routine Task Automation

By capitalizing on AI in finance, financial organizations are automating their operations and reaping the rewards of this technology.

A key example is the use of conversational AI in finance. AI-powered virtual assistants can interact with customers, offering real-time support and assistance. These intelligent chatbots can manage routine inquiries, account management, and basic transactions, freeing human resources for more complicated tasks.

Within the finance sector, the amalgamation of AI and machine learning (ML) plays a pivotal role in process automation. ML algorithms can analyze vast quantities of financial data, recognize patterns, and make predictions. This facilitates automated data entry, document processing, and reconciliation, reducing manual effort and enhancing accuracy.

The advantages of AI in finance are considerable. By automating routine tasks, financial institutions can streamline operations, cut costs, and boost accuracy. Moreover, employees can focus on higher-value activities such as financial analysis and decision-making, leading to better strategic outcomes.

The implementation of AI in financial services for routine task automation is transforming the finance sector.

Take advantage of AI in your finance business and provide an unmatched experience to your users by utilizing our top-tier services.

Client Wealth Management

The wealth management sector in banking has seen significant investments in AI. Both established and emerging players recognize the impact of the ongoing digital transformation in the banking arena on this sector. Leading industry firms are acquiring tech startups that specialize in the automatic analysis of copious amounts of unstructured data, aiming to identify common behavioral patterns. The goal is to create AI engines that can provide guidance on best serving their high-value clients. By automating significant portions of the wealth management process, they can offer customized, tax-efficient investments to clients who traditionally would not qualify for professional wealth management due to lower investable assets.

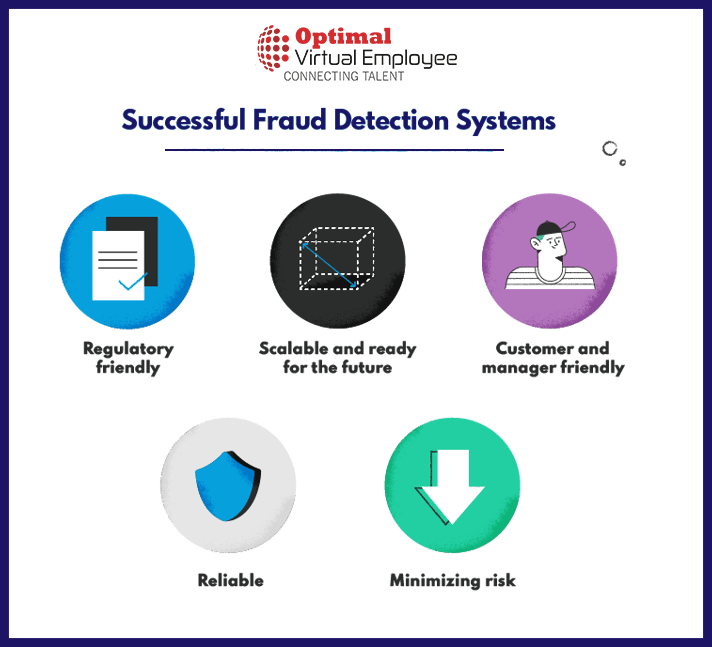

Proactive Fraud Prevention

AI allows for the simulation of numerous scenarios where fraud or cybercrime might occur. Thus, AI in finance adopts a forward-thinking approach to secure the financial services environment. System designers no longer have to wait for a fraudulent incident to occur before implementing safeguards. AI is promoting innovation in finance by securing its products and services via continuous comprehension of human psychology. Furthermore, AI in finance also ensures stringent regulatory compliance by enforcing policies, rules, and security measures during the design and delivery of financial services.

Generating Valuable Insights

Insight generation is the process of extracting actionable intelligence from the continually growing volumes of raw data available. With global data nearly doubling every year, it’s unsurprising that handling this data complexity is a major challenge in achieving digital transformation. One of the rapidly expanding uses of AI is to monitor all customer communications – be it direct interactions with a company or external conversations about it – across different platforms like call centers, chat sessions, and social media.

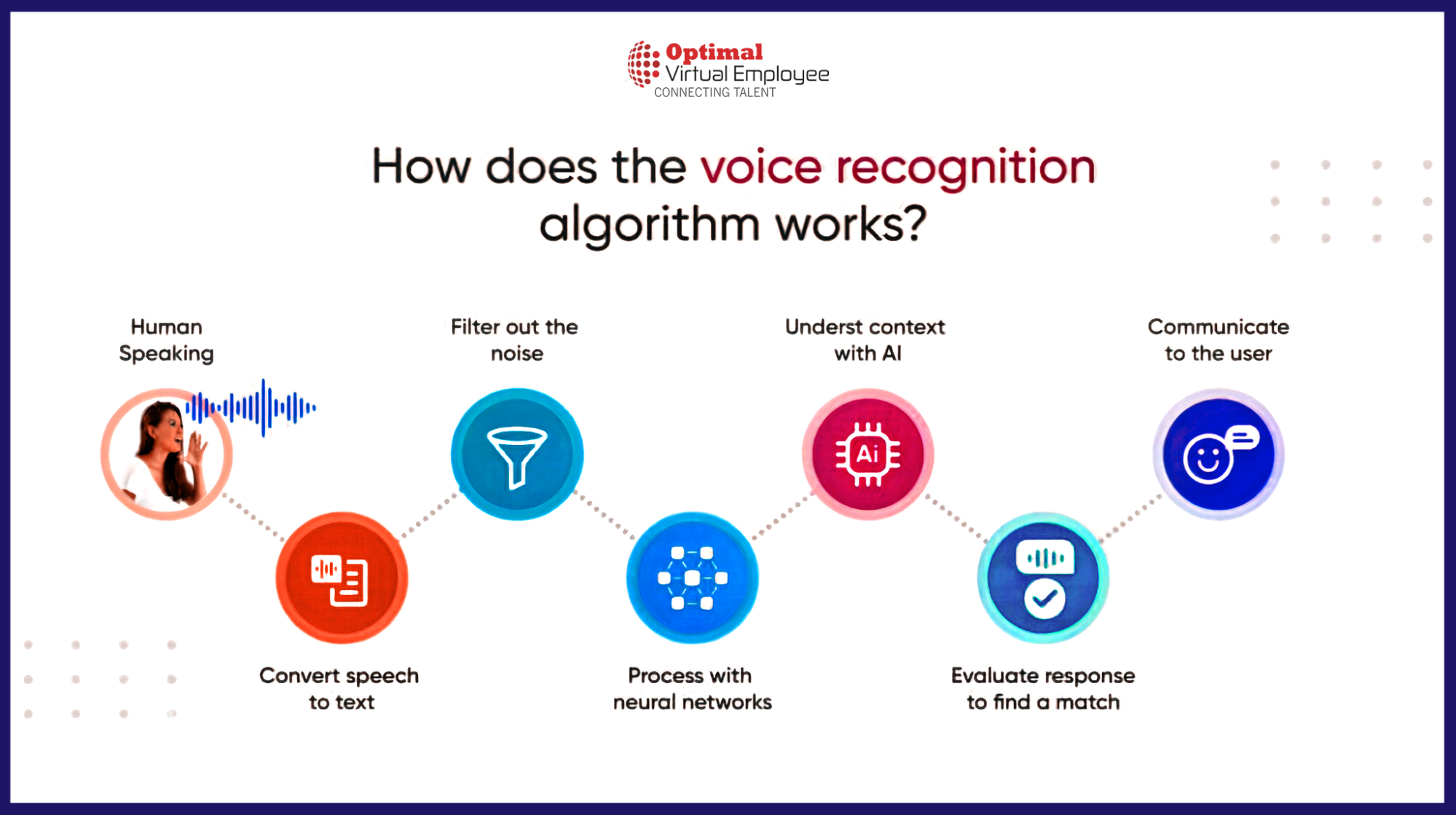

Voice-Enabled Banking

This technology enables customers to use banking services through voice commands, replacing the need for a touchscreen. Natural language technology can process requests to answer queries, locate information, and connect users with various banking services. Barclays, for instance, is developing a technology akin to Apple’s Siri, which allows users to conduct money transfers through conversations with a robotic computer system.

Accelerating Business Operations

Business acceleration relates to how companies use AI to speed up knowledge-based activities to enhance efficiency and performance. For instance, financial institutions create investment strategies for their investors. While these activities are often seen as opportunities to cut costs through internal process automation, they should also be viewed as a means to transform the customer experience. For instance, if a bank can use AI to reduce the time it takes to approve a loan, it not only lowers its operational costs but also significantly improves the customer experience.

Conclusion

In conclusion, the ever-evolving field of AI is fundamentally reshaping the landscape of financial services, from compliance and fraud detection to customer service and operations. AI’s ability to handle vast volumes of data and make sense of complex patterns is creating unprecedented opportunities for financial institutions to streamline their operations, improve accuracy, and deliver enhanced customer experiences.

In the realm of compliance, AI is automating arduous, repetitive tasks and improving accuracy in adhering to regulations. AI systems are now capable of performing real-time analysis of customer data, spotting potential risks, and flagging suspicious activities, thereby making compliance procedures more efficient, cost-effective, and reliable. The role of AI in transforming compliance processes, thus, represents a significant leap forward for the finance sector.

Similarly, the application of AI in fraud detection is making financial environments safer. By simulating countless fraud scenarios, AI adopts a proactive approach to risk mitigation, identifying potential threats even before they occur. The ability of AI to safeguard financial services while ensuring strict regulatory compliance signifies a major advancement in the sector.

Furthermore, AI’s role is not confined to compliance and fraud detection; it is equally transformative across the financial sector. Its applications in personalized wealth management, predictive analysis, algorithmic trading, and customer service signify the profound impact AI is set to have on the financial landscape.

Overall, as AI continues to evolve and integrate more deeply into the financial sector, its transformative impact will only expand. Financial institutions that adopt and harness the power of AI will be the ones to gain a competitive edge in this new era of digital finance. It’s clear that the future of financial services is intertwined with the evolution of AI, signaling a new age of innovation, efficiency, and enhanced customer service in the financial sector.